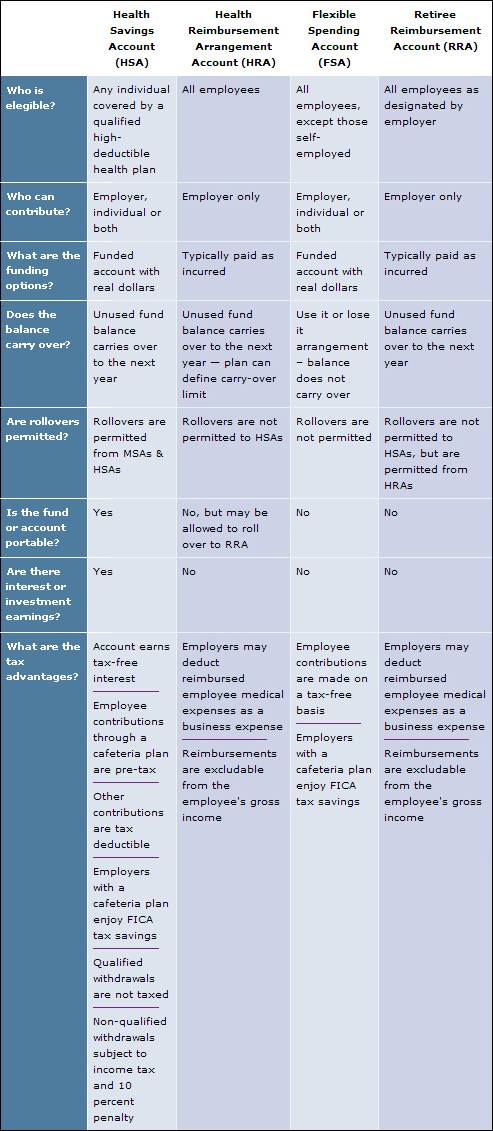

What's What - FSA, HSA, HRA, RRA - The Basics:

Flexible Spending Account (FSA)

FSA Fast Facts - With an FSA, money is taken from your paycheck before taxes (you set the amount) and put into an account. You can then use that money to pay for medical expenses throughout the year. It's important to understand that FSAs have a "use it or lose it" provision . meaning that you must use the dollars in the year in which they are saved or you will lose them at the end of the year. Check with your plan to make sure expenses are "covered," meaning they are approved by the Internal Revenue Service as a qualified medical expense that can be paid for with your tax-free dollars. For example, while the cold medicine and band-aids you pick up at your local pharmacy can be paid for with your FSA funds, the magazines you buy at that same pharmacy would not be covered.

Click here for a full list of allowable FSA health care expenses.

FSA Fast Facts:

- Money you put in is free of federal, Social Security and most state taxes.

- Your money must be spent in the year you put it in. Any left over money will be (gasp) returned to your employer.

- You can't take the money with you if you leave your current job, and you will not receive interest on your account.

Common FSA health care expenses:

Copay and deductibles (for doctor office visits)

Eyeglasses, contact lenses and LASIK surgery

Chiropractic treatment and alternative therapies

Dental work and orthodontia

Some over-the-counter medicines such as antacids and cold medicines

Health Savings Account (HSA) HSA Fast Facts - With an HSA, traditionally money may be taken from your paycheck before taxes or you can open up an individual HSA account and contribute money on your own. Your employer or a family member can also contribute to your HSA. To qualify for an HSA you must be a member of a "high-deductible health plan." This means that your plan . in many cases a PPO . requires that you pay a certain amount of money up front before your plan coverage kicks in. The great news is that your HSA funds can be used to pay for this deductible. You can also use this money into the future . letting you save for medical expenses down the road. So, even if you chicken out on your LASIK eye surgery, you don't lose that money.

HSA Fast Facts:

- Money you put in is tax deductible from federal income tax and many state income taxes and can earn interest tax free, a great way to save for future health care expenses.

- The money in your HSA is yours - no matter who put the money in the fund. That means you can take your account with you if you change jobs, and even use it in retirement.

- Preventive care (like annual ob-gyn visits) may be covered at 100 percent - meaning less money you have to spend out of your pocket.

- To qualify for an HSA the Federal Government says that you must be a member of a "high-deductible health plan." This means that your plan - in many cases a PPO - requires that you pay a certain amount of money up front before your health coverage kicks in.

- The money you put in earns interest and builds from year to year.

- Although meant for medical expenses, you can also withdraw cash from your account - though the money is then taxed. You may also have to pay an extra fee.

Health Reimbursement Arrangement (HRA)

HRA Fast Facts - An HRA is an account offered to employees or retirees, where you can use the money to pay for deductible and co-insurance amounts, or covered medical expenses. Like an HSA, leftover dollars generally can be used from year-to-year, as long as you continue to be a member of the plan. Also, the money is contributed by your employer and doesn't count as income; saving you valuable tax dollars - complete with Uncle Sam's stamp of approval.

HRA Fast Facts:

- You can carry your unused balance over from year to year, as long as you're still covered under the plan.

- Check with your plan to see if you can use any money left in the account if you leave your job. Some employers let you; others don't.

- Preventive care (like annual ob-gyn visits) may be covered at 100 percent - meaning less money you have to spend out of your pocket.

- If your employer is extra nice, they can also credit interest to your account.

Retiree Reimbursement Account (RRA)

RRA Fast Facts - This is a type of HRA where the money is available to use for covered medical expenses once you retire. The RRA is funded solely by employer contributions. You can't add money to these accounts. These funds are available to reimburse covered health care expenses in retirement. Only "covered expenses" as defined by the plan can be reimbursed by an RRA. These rules are set by your employer; RRAs often cover insurance premiums for Medicare or Medigap coverage as well as most traditional health-related expenses. RRA balances grow while you are employed, and in retirement the unused balance rolls over from one year to the next.

RRA Fast Facts:

- An RRA can provide choice and stability in helping you pay for your health care expenses when you retire.

- "Covered expenses" frequently include insurance premiums, like Medicare or Medigap coverage and medical expenses as defined by the plan.

- An RRA often has no age limits on money put into the account. Employers may choose to put in money even after you've reached retirement. Yes, it's really true!

Small Business Insurance Resources and Links

Department of Insurance Financial Insitutions & Professional Registration

Missouri Business